how much federal taxes deducted from paycheck nc

Its important to note. Thats the law whether.

Here S How Rising Inflation May Affect Your 2021 Tax Bill

For Medicare taxes 145 is deducted from each paycheck and your employer matches that amount.

. Medicare tax is levied on all of your earnings with no upper income threshold or limit. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck.

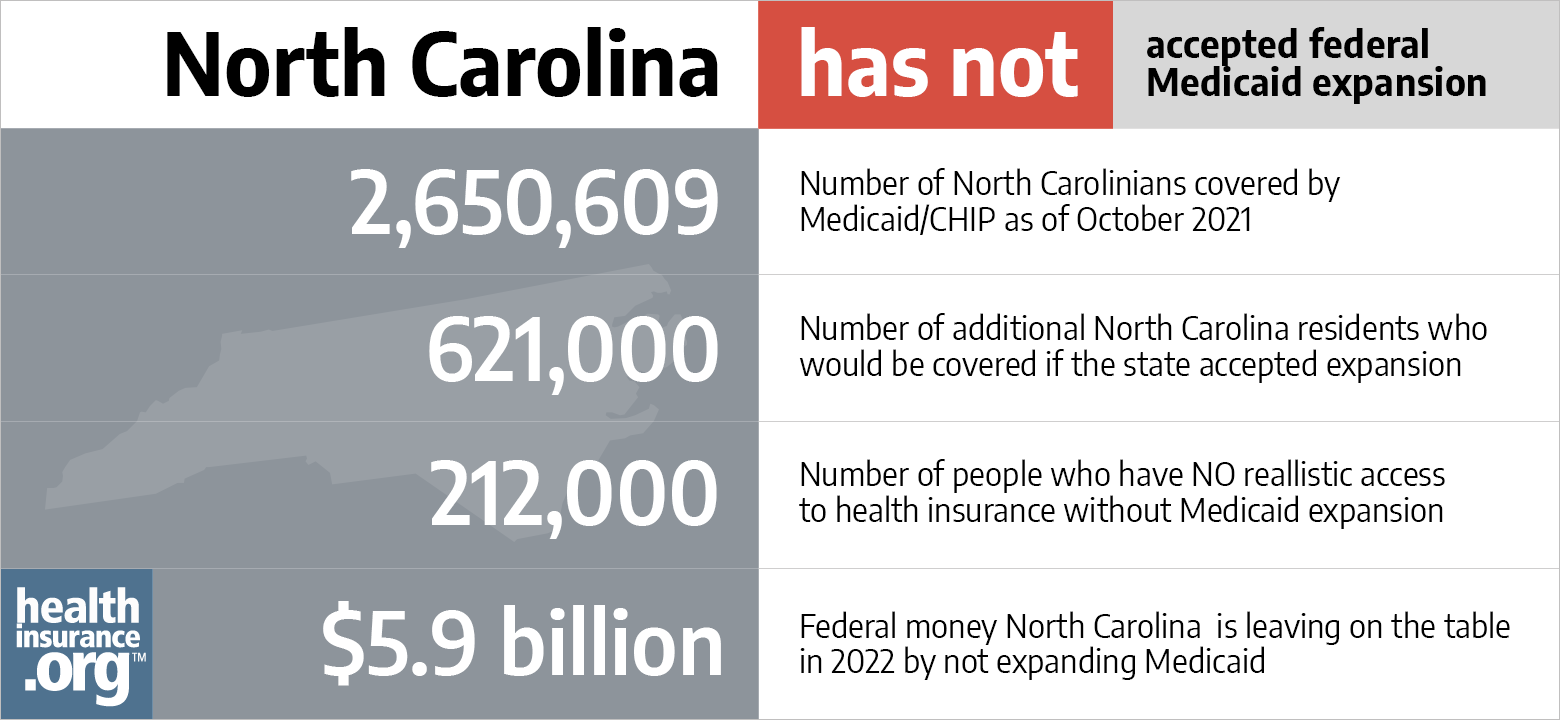

How do I calculate payroll taxes. The act went into full effect in 2014 but before then North Carolina had a three-bracket progressive. There is a flat income tax rate of 499 which means no matter who you are or how much you make this is the rate that will be.

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. Dont send it to the IRS. Employers must withhold this tax on employees who earn 200000 or more in a year.

The IRS recommends having your most recent paystub and your most recent income tax return handy before beginning. As of 2015 FICA taxes for Social Security take 62 percent of your salary up to 118500. Eligible plan types include traditional IRAs and 401ks.

Your taxes may also be impacted if you contribute a portion of your paycheck to a tax-advantaged retirement savings account. Any income exceeding that amount will not be taxed. Additional Medicare Tax Some employees will have to pay the 09 Additional Medicare Tax depending on their income and filing status.

If you earn more than 200000 in a year your employer must withhold an additional 09 percent for the additional Medicare tax. North Carlinians pay a flat income tax rate of 525 regardingless of filing status. For the employee above with 1500 in weekly pay the calculation is 1500 x 765 0765 for a total of 11475.

These are contributions that you make before any taxes are withheld from your paycheck. In most cases youll be credited back 54 of this amount for paying your state unemployment taxes on time resulting in a net tax of 06. Your employer pays another 62 percent on your behalf.

In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes. The Department of Revenue Department must notify the payer that the TIN is invalid. This 6 federal tax on the first 7000 of each employees earnings is to cover unemployment.

What taxes do North Carolinians pay. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you.

North Carolina has not always had a flat income tax rate though. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out. How much do you make after taxes in North Carolina.

Social Security tax and Medicare tax are two federal taxes deducted from your paycheck. Also deducted from your paychecks are any pre-tax retirement contributions you make. Your employer pays an additional 145 the employer part of the Medicare tax.

And just like the North Carolina Form NC4 keep Form W-4 for your records. How Much Is Payroll Tax In Nc. North Carolina Payroll Taxes There is a flat income tax rate of 525 which means no matter who you are or how much you make this is the rate that will be deducted.

For Tax Years 2019 and 2020 the North Carolina individual income tax rate is 525 00525. Every taxpayer in North Carolina will pay 525 of their taxable income for state taxes. To use the calculator go to httpswwwirsgovindividualsirs-withholding-calculator.

The Calculator will help you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. North Carolina payroll taxes are as easy as a walk along the outer banks. Your employer withholds 145 of your gross income from your paycheck.

For Medicare you both pay 14 percent no matter how much you make. There are no income limits for Medicare tax so all covered wages are subject to Medicare tax. The Social Security tax is 62 percent of your total pay until you reach an annual income threshold.

Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. The percentage rate for the Medicare tax is 145 percent although Congress can change it. What is the NC tax rate for 2020.

A married couple with a combined annual income of 106000 will take home 8414475. North Carolina Payroll Taxes. To determine each employees FICA tax liability multiply their gross wages by 765 as seen below.

If you would like a more detailed explanation of federal payroll taxes head on over to our step-by-step guide for additional information. If you have taxable income you owe every penny regardless of whether your employer took the pennies out of your paycheck. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches.

You pay the tax on only the first 147000 of your earnings in 2022. Effective January 1 2020 a payer must deduct and withhold North Carolina income tax from the non-wage compensation paid to a payee. A single filer earning 53000 per year will take home 4207237 after tax.

The amount of taxes to be withheld is four percent 4 of the compensation paid to the payee. North Carolina Payroll Taxes There is a flat income tax rate of 525 which means no matter who you are or how much you make this is the rate that will be deducted. Why Use the Estimator When Should You Use the Estimator.

Contributions to these plans are considered pre-tax and are therefore exempt from federal income tax during the year in which you make the contribution.

Aca Medicaid Expansion In North Carolina Updated 2022 Guide Healthinsurance Org

North Carolina State Taxes 2022 Tax Season Forbes Advisor

Cost Of Living Data Series Missouri Economic Research And Information Center Cost Of Living Missouri Economic Research

Wages Don T Cover Rent For Low Income People In Lancaster County Study Shows Homeless Rent The Unit

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Understanding Your Paycheck Http Www Hfcsd Org Webpages Tnassivera News Cfm Subpage 1077 Student Teaching Teaching Activities Understanding Yourself

Irs Form 1096 Irs Forms Irs Internal Revenue Service

North Carolina Paycheck Calculator Smartasset

Temporary Employment Contract Template

North Carolina Providing Broad Based Tax Relief Grant Thornton

It S Tax Season Use Your Refund To Jump Start Your Down Payment Savings Tax Season Tax Refund Tax Time

North Carolina Income Tax Calculator Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

How Much Income You Need To Afford The Average Home In Every State The Housing Market Has Not Only Infographs Housing Investi Map Usa Map 30 Year Mortgage

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation