child tax portal says not eligible

Check your processed payment tab. If your modified adjusted gross income is too high then you wont get a child tax credit.

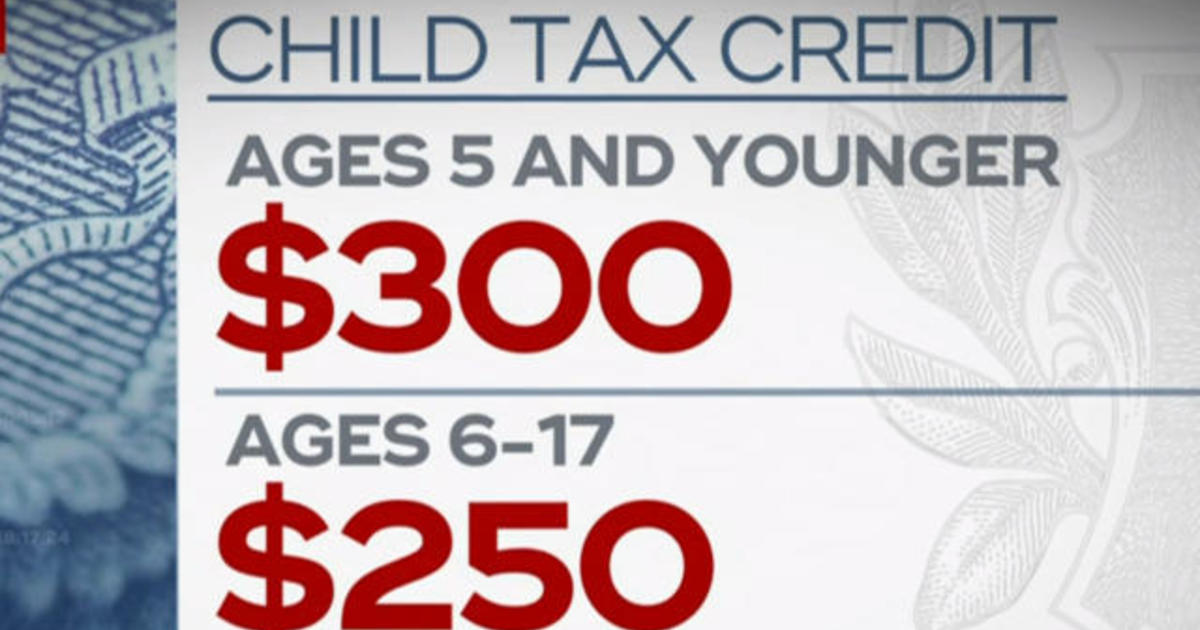

Parents Guide To The Child Tax Credit Nextadvisor With Time

150000 if married and filing a joint return or if filing as a.

. But my fiance didnt we both filed our 2020 taxes each clamied a kid under 5 years old filed separately. Of course I cant talk to a person Im in Lynchburg Virginia. Where are you currently located.

That they havent updated it and other people are going thru this issue. The Child Tax Credit Update Portal is no longer available. Web Checked again this morning and it says not eligible.

Your 2021 Baby Makes You Eligible for the Child Tax Credit Find. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Web Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you.

You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account. On the portal it says that shes not eligible I called the IRS they said to check every day. No high-income individual or high-income household in the top 5 of.

If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive then your child is a qualifying child for purposes of the 2021 Child Tax Credit. Web 2 days agoBorrowers are eligible for this relief if their individual income is less than 125000 250000 for married couples. How old are you.

This does not. Web One South Carolina mother reached out to the Washington Post upset that she did get the advance child tax credit payments for her two children aged 9 and 10 500 but not for her 17-year-old. If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive then your child is a qualifying child for purposes of the 2021 Child Tax Credit.

Web The IRS website says Im not eligible for the child tax credit and I do believe I am. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. Web I got my child tax credit.

Ad Parents E-File to Get the Credits Deductions You Deserve. As a result you were eligible to receive advance Child Tax Credit payments for your qualifying child. This does not.

Web 2 days agoYoure eligible for the deduction if you paid student loan interest in the given tax year and if you meet modified adjusted gross income requirements your income after eligible taxes and. The Accountant can help. You can no longer view or.

Your 2021 Baby Makes You Eligible for the Child Tax Credit Find. How the Child Tax Credit Will Affect Your 2021 Taxes Additionally you and your child must be US. What is your typical filing status.

How the Child Tax Credit Will Affect Your 2021 Taxes Additionally you and your child must be US. Web child tax portal says not eligible Friday August 19 2022 Edit.

Child Tax Credit Schedule 8812 H R Block

The Advance Child Tax Credit What Lies Ahead

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

The December Child Tax Credit Payment May Be The Last

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Did Your Advance Child Tax Credit Payment End Or Change Tas

What Can I Do If I Didn T Get My Child Tax Credit Payment

The Child Tax Credit Toolkit The White House

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

The Child Tax Credit Toolkit The White House

Child Tax Credit Here S Why Your Payment Is Lower Than You Expected The Washington Post

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Scam Alert Child Tax Credit Is Automatic No Need To Apply Oregonlive Com